Raising Request for Loan after Registration

Specify loan request details :

- Loan amount

- Period of repayment

- Frequency of repayment

- Purpose of the loan

The borrower will be required to furnish:

- Bank Statement of last 6 months (Consent for accessing the bank statement thru Account Aggregator, or PDF of the bank statements of all banks where the applicant has bank account)

- Bank account number for digital payment (UPI – Mandate, e-NACH)

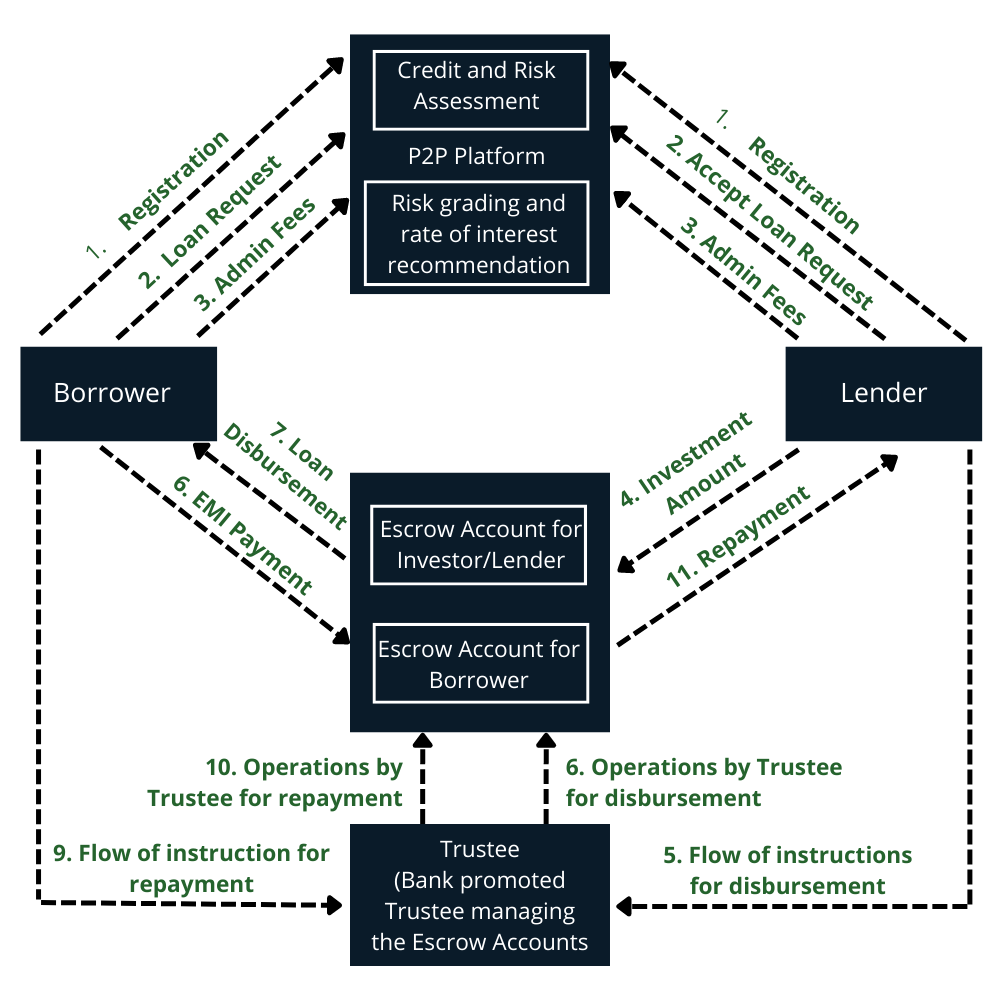

How It Works?

Step 1: Registration & Onboarding

Register as a borrower/investor by providing required documents to create an account. Raise request for loan & pay processing fees. After diligence on submitted documents the credit rating, risk evaluation, the case is posted to the Internal market place for the lenders

Step 2: Loan Application

Borrower raises loan request, stating the requested loan amount, duration of loan, and the purpose for which the loan needed.

Banks statement for last six months has to be uploaded by the borrower. Alternatively, the borrower will provide consent to receive the requisite asset and transaction details from the borrower's bank, through the Account aggregator (AA).

Step 3: Credit Appraisal and Risk Profiling

After diligence on submitted documents & its verification, the Platform caries out the Credit Appraisal and Risk Profiling of the borrower. Based on the Risk profile, the rate of interest applicable for the loan is determined, and based on the repaying capacity of the borrower, the equated loan instalment is determined for the repayment frequency and the duration requested for.

Subsequently the Platform, generates a loan offer that mentions the loan amount approved, applicable, rate of interest, repayment frequency duration of the loan repayment, and the terms and conditions.The loan offer is presented to the borrower for acceptance.

Step 4: Loan Listed in Marketplace

Once loan application has been approved and the borrower agrees to/accepts the terms of lending, the loan is listed on Marketplace for lenders to fund the loan.

Once the loan is put in the marketplace, the platform matches the lender preferences with the loan profile, and in case of preferences fully matching, carries out auto-investment to the extent indicated and possible by the lenders.

If any loan amount remains unfunded after the round of autot-investing, the loan open to other lenders for investing. Based on the product, the loan listing remains active for a specified period, within which the lenders can commit funds. If any loan does not get fully funded within the listing period, or the borrower decides to withdraw the loan request, the listing is closed and any funds committed by lenders are unlocked.

Once the loan is fully funded, and the borrower accepts the funding, the loan is ready for documentation and disbursement.

Borrower is kept updated on the progress of funding of the loan during the listing period

Step 5: Documentation and Loan Disbursement

After the acceptance of the loan funding, the borrower is presented the legal loan agreement for digital signing. The loan agreement contains all the terms and conditions of the loan. The Platform signs the loan agreement with the borrower on behalf of all the participating lenders, based on their mandate). Borrower also agrees to e-NACH/UPI Mandate for repaying the loan instalments.

After the execution of the loan agreement, appropriate instructions are sent the ESCROW TRUSTEE for payment of requested amount (net of any Platform charges) to the borrower's bank account by debiting the Lender's Escrow Account.

Step 6: Regular Returns to Lenders

Borrower repayments (loan instalments) are received directly in the Borrowers' Escrow Collection Account. The Trustee as per the agreement of the borrower and the detailed instruction on fund transfer, the Repayment is distributed to lenders.

Upon receipt of any repayment, the Platform sends appropriate instructions the Trustee to transfer the funds to the Lenders' Escrow Account (net of any Platform Charges). The amount received is updated in the wallets of the lenders who funded the loan. Lenders are allowed to withdraw money from their wallets whenever they wish.