Sample Loan Agreement

This loan agreement (hereinafter referred to as the “Agreement”) is made and executed at ___________________________ on this _______ day of _____________ month, 20__.

BETWEEN

The lenders whose name and particulars are as stated in Schedule I, hereinafter referred to as “the Lender” when referring to as single lender or “the Lenders”, which expression shall, unless it be repugnant to the context shall mean and includes its legal heirs, legal representatives, assignee, nominee(s) and administrator;

AND

Mr./Mrs./Ms. __________________ (PAN: ______________) son/daughter/wife of Mr. ___________, aged about ____ years, residing at _____________________________, hereinafter referred to as “the Borrower” which expression unless repugnant to the context shall mean and includes its legal heirs, legal representatives, assignee, nominee(s) and administrator;

The “Lenders”, the “Borrower”, are hereinafter collectively referred to as the “Parties” and individually as the “Party”.

WHEREAS

A. The Borrower is desirous of availing a loan of an aggregate amount of Rs. ______/- (Rupees _______________ only) from the Lenders for the purpose of ________.

B. The Lenders agree and express their consent to the terms of this Agreement in the manner stated hereinafter, and shall lend the amount committed by each of them, subject to and in accordance with the terms contained in this Agreement.

C. The Borrower has registered with P2PL to avail the loan and the Lenders are desirous of investing their funds through P2PL. P2PL, a Non-Banking Financial Company – Peer to Peer Lending Platform (NBFC-P2P), is an online marketplace that provides its services in relation to connecting credit-worthy borrowers seeking transparent, cost-effective short-term personal loans with Lenders who are looking for returns on their investments as per the terms provided under the Participant Agreement.

IN CONSIDERATION OF THE MUTUAL PROMISES, COVENANTS AND CONDITIONS HEREINAFTER SET FORTH, THE RECEIPT AND SUFFICIENCY OF WHICH IS HEREBY ACKNOWLEDGED, THE PARTIES HERETO AGREE AS FOLLOWS

NOW THIS AGREEMENT WITNESSETH AS FOLLOWS:

1. DEFINITIONS AND INTERPRETATION

In this Agreement (including any recitals, annexure, schedules or exhibits attached thereto), except where the context otherwise requires, the following words and expressions shall have the following meaning:

1.1) “Act” means the Reserve Bank of India Act, 1934.

1.2) “Non-bank financial company – Peer to Peer Lending Platform” (“NBFC-P2P”) means a non-banking institution which carries on the business of a Peer to Peer Lending Platform.

1.3) “RBI Directions” (Reserve Bank) Directions, 2017, as may be amended from time to time, or such other directions as may be issued by the RBI in this regard.

1.4) “P2PL” is owned by iMFAST Finfotech Private Limited, a Non-banking Financial company – Peer to Peer Lending Platform (NBFC-P2P) having its registered office at G5, Swiss Complex, 33, Race Course Road, Bangalore-560001, which acts as an intermediary providing the services:

• Platform for investors to lend money based on their conditions for borrowers; their registration and eligibilities

• Platform for borrowers to present their borrowing needs and seek loan from lenders; their registration and eligibilities.

• Platform provides matching of borrowers’ requirements and lenders conditions through its crowd funding (lenders funding) conforming to RBI regulatory requirements; creating dossier on borrowers giving profile, risk rating, credit rating, and social media rating; legal documentation; disbursement, repayment accounting, interest & penalty and early closure of loan; lenders and borrowers loyalty program.

• Maintaining compliances of RBI regulations and confidence of lenders and borrowers.On demand services of lenders including but not limited to physical verifications, helping a legal case, MIS, etc.

• Platform uses industry standard online verification systems and automation of processes to speed up the processes and keep the lower cost of implementation.

2. SCOPE

• The Parties agree that the Borrower and the Lenders are registered and verified by P2PL and enlisted on the Website to avail a loan and invest funds in such loans respectively, as per the terms and conditions set forth in this Agreement.

• Upon successful registration and verification and processing of the loan applications, the loan request is put in the registered lenders’ marketplace, where the borrowers of the listed loans will receive offers from the Lenders to fund the Listing and the Borrower and the Lenders shall digitally sign and execute this Loan Agreement, the terms of which are mentioned hereunder.

3. PURPOSE OF THE LOAN

The Borrower hereby confirms that the amount borrowed from the Lenders shall be used only for the purpose of _____________.

4. LOAN TERMS

4.1) Loan Amount

The Lenders have collectively agreed to grant to the Borrower, a sum of Rs. __________/- (Rupees __________ only) (hereinafter referred to as “the Loan Amount”) in the proportion as detailed in Annexure I.

4.2) Loan Tenure

The loan provided under this Agreement shall be for a period of ____, subject to Clause 4(i). The loan tenure shall not be extended even with mutual consent of both parties in writing.

4.3) Fund Transfer and Disbursement

Transfer of funds between the Parties shall be governed by the Fund Transfer Mechanism in accordance with the RBI Directions. The Lenders shall transfer their committed funds from their bank account via NEFT, RTGS or any other mode of payment as may be specified to the P2PL Escrow Account. Once all the funds are received from the Lenders as per the proportion mentioned in Clause 4(a) and upon execution of this Loan Agreement between the Borrower and the Lenders, the amount shall be disbursed from the P2PL Escrow Account to the Borrower’s bank account within 3 – 5 working days.

The date of disbursal of the loan shall be the Loan Date (“Loan Date”). The details of the Borrower’s bank account are as follows:

| Name of Account Holder | : |

| Account Number | : |

| IFS Code | : |

| Branch | : |

| Bank Name | : |

| Account Type | : |

| Disbursement into designated account | : |

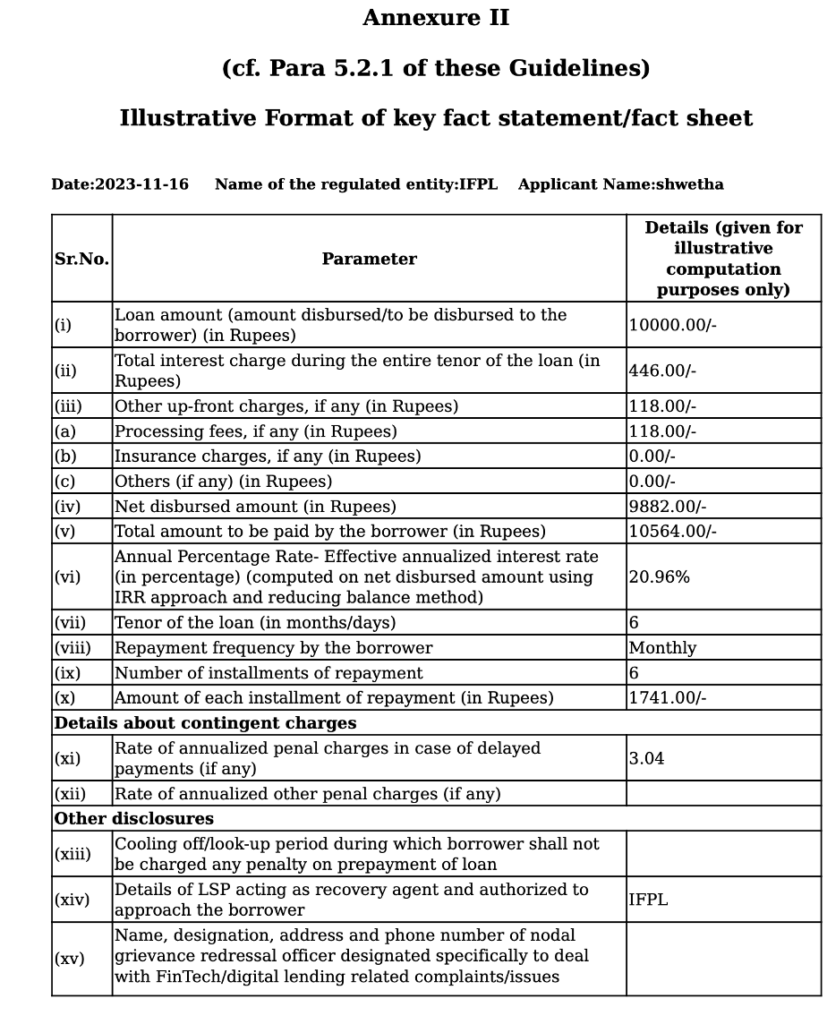

4.4) Interest

The fixed rate of interest on the loan availed by the Borrower shall be ___ % per annum with monthly rest compounding. The Annualized Percentage Rate of interest will be as stated in Annexure II – Key Fact Statement.

4.4.1) The rate of interest applicable to the loan is compounded monthly and calculation is based on daily loan account balance product.

4.4.2) For purpose of computation of interest, Actual/Actual method will be applied, by considering actual days per calendar month.

4.4.3) Any dispute being raised about the amount due, or interest computation shall not enable the Borrower to withhold payment of any instalment.

4.5) Repayment of Loan and EPI Schedule

At every agreed repayment frequency, the equated payment instalment (EPI) amount shall be auto-deducted from the Borrower’s bank account to the P2PL Escrow Account. EPI collected from the Borrower shall automatically be split and transferred to respective Lenders’ accounts who funded the Listing.

4.6) Mode of Payment of EPI

All repayments made by the Borrower to the Escrow Account, under or in terms of this Agreement shall be made via bank transfer/UPI Mandate into the Escrow account. Repayments may also be made through Bank Cheques, IMPS, NEFT, demand draft and other auto debits.

The Borrower shall provide before the loan disbursement, 1 e-NACH or UPI Mandate favoring the P2PL account. The e-NACH/UPI Mandate will be for a maximum amount equal to the Loan Amount to accommodate penal charges. P2PL shall only process the NACH Mandate for the regular EPIs or for the amount overdue each month.

The Borrower agrees and acknowledges that without prior written consent of the Lenders, the Borrower shall not close that bank account from which the NACH/UPI Mandate has been facilitated and make alternate arrangement for the payment of the balance instalments. Any instruction for closure of the bank account without the consent of the Lenders shall be deemed to be an event of default and consequence as set out in Clause 8 shall ensue.

4.7) Non – Encashment of e-NACH/UPI Mandate

If any payment claim via e-NACH/UPI Mandate is dishonored by the Borrower’s Bank, Borrower will immediately make alternate arrangements to pay the amounts due and via alternate means.

If the e-NACH/UPI mandate by the Borrower is / become(s) non-encashable due to the death of the Borrower then in such an event, the Lenders claims under this Agreement can be settled from the estate of the deceased Borrower if the estate is solvent, then the legal heir(s) / representative(s) of the deceased will be responsible for paying the Lenders claim under this Agreement.

4.8) Prepayment of Loan

The Borrower may at any time pre-pay the loan subject to the conditions as stipulated in Annexure II – Key Fact statement.

Each and every Borrower availing a loan on the website of the P2PL may, apart from the Cooling off period specified in the KFS, in their own discretion and upon payment of due principal, interest and bank charges to the Lenders and fees payable to the P2PL can foreclose their loan after three (3) months from the date of his/their first EPI In such an event, the Borrowers shall remain bound to pay all charges due to the P2PL if any. Post ascertaining all particulars by the P2PL and the payment of dues by the Borrowers this loan Agreement will stand duly terminated.

The above conditions are subject to change at the sole discretion of P2PL and any such changes shall be available on the Website. These changes shall be effective for on- going loans as well as new loans.

4.8.1) Appropriation of Payments

In case the e_NACH/UPI Mandate given in favor of the Lenders are not realized or in case of delayed payments by the Borrower, the Borrower agrees and acknowledges that the costs / due payments out of the monies received from the Borrower shall be appropriated in the following order:

4.8.1.1) Costs, charges, expenses and other monies incurred by P2PL in getting the due payments from the Borrower.

4.8.1.2) Late fee and penal charges, if any due to the Lenders.

4.8.1.3) Interest due and payable in terms of the Loan Agreement

4.8.1.4) Principal due and payable in terms of the Loan Agreement.

4.8.2) Discharge of Loan

Upon repayment of the entire Loan Amount, interest thereon and any other fee and charges due to the Lenders, the Borrower shall stand discharged of all their obligations under this Agreement.

5. LENDERS OBLIGATIONS

The Lenders agree to:

a. To provide accurate and true information.

b. To fund the committed amount to the Borrower;

c. To maintain sufficient balance in the bank account for the payment of the committed amount;

d. Due performance of all the terms and conditions provided under this Loan Agreement; Each of the Lenders agrees that, in connection with any Listing, commitments, loans or other transactions, he shall not:

e. Make any false, misleading or deceptive statement(s) or omit any material fact;

f. Misrepresent his identity, or describe, present or portray them as a person other than himself;

g. Give to or receive from, or offer or agree to give to or receive from the Borrower or other person connected to the Borrower any fee, bonus, additional interest, kickback or thing of value of any kind, including in exchange for such person’s commitment, recommendation, or offer or agreement to recommend or make a commitment with respect to the Listing.

6. BORROWER OBLIGATIONS

The Borrower agrees to:

a) To utilize the entire Loan Amount for the purpose mentioned in Clause 3 of this Agreement;

b) To promptly notify any event or circumstances, which might operate as a cause of delay in the fulfilment or compliance of any terms or conditions specified under this Agreement;

c) To provide accurate and true information;

d) To repay the entire Loan Amount along with interest due thereon and any other fee and charges payable to the Lenders within the time specified under this Agreement or any other agreement, without any default or delay

e) To maintain sufficient balance in the bank account for payment through ECS or PDCs issued by the Borrower on the day when any EMI becomes due and thereafter to honour all such PDCs.

f) Due performance of all the terms and conditions provided under this Loan Agreement. The Borrower agrees that, in connection with any Listing, commitments, loans or other transactions, he shall not:

g) Make any false, misleading or deceptive statement(s) or omit any material fact;

h) Misrepresent his identity, or describe, present or portray himself as a person other than himself;

i) Give to or receive from, or offer or agree to give to or receive from, any Lenders or other person connected to the Lenders any fee, bonus, additional interest, kickback or thing of value of any kind, including in exchange for such person’s commitment, recommendation, or offer or agreement to recommend or make a commitment with respect to the Listing.

j) The Borrower shall indemnify the Lenders to the extent of all reasonable and direct legal costs which may be incurred by the Lenders in connection with enforcing the repayment of the Loan Amount, interest thereon and any other fee and charges payable to the Lenders under this Agreement.

7. REPRESENTATIONS AND WARRANTIES

The Parties represent and warrant that they have not withheld or misrepresented any material information which could have an adverse effect on any act, transaction or any other aspect contemplated under this Agreement.

a. Each party to the Agreement makes the following representations and warranties with respect to itself, and confirms that they are, true, correct and valid:

b. It has full power and authority to enter into, deliver and perform the terms and provisions of this Agreement and, in particular, to exercise its rights, perform the obligations expressed to be assumed by and make the representations and warranties made by it hereunder;

c. Its obligations under this Agreement are legal and valid, binding on it and enforceable against it in accordance with the terms hereof;

d. The Parties to the Agreement warrant and represent to have the legal competence and capacity to execute and perform this Agreement;

e. Each of the Lenders hereby represents and warrants:

f. That all information provided by him is accurate and true to the best of his knowledge

g. Lender holds a bank account in his own name and will use this account for the purpose of this Agreement;

h. That the Lenders are not restricted to enter into this Loan Agreement by any law and the amount sought to be invested is within the limits prescribed under the RBI Directions, as may be amended from time to time;

i. That this Loan Agreement and all documents required to be executed under and / or in relation to this Loan Agreement constitute and shall constitute valid and binding obligations of the Lenders enforceable in accordance with law.

j. The Borrower hereby represents and warrants:

k. That all information provided by him is accurate and true to the best of his knowledge; The Borrower holds a bank account in his own name and will use this account for the purpose of this Agreement.

l. That there are no circumstances whatsoever that would render the transaction contemplated by this Loan Agreement, void or voidable at the instance of the Borrower, under the provisions of any law in force in India;

m. That there is no material action, suit proceeding, order or investigation pending and / or continuing or to the knowledge of the Borrower initiated by or against the Borrower before any court of law.

n. This Agreement shall become null and void and have no effect and all obligations of the Parties hereunder shall terminate provided that the loan is not completely funded within 10 days of the agreement date.

8. DEFAULT

Upon the occurrence of any of the events specified in Clause 8.d the Lenders may require the Loan Amount, interest thereon and any other fee and charges, to the extent such amounts have not been repaid to the Lenders, by notice to the Borrower, to become due and payable.

Upon failure to do so, P2PL may, on behalf of the Lenders, take such necessary steps including but not limited to appointing collection agents, recoveries team, attorneys, advocates, experts or other persons, to commence, prosecute, enforce all actions, suits and other legal proceedings etc against the Borrower to realize the Loan Amount, interest thereon and any other fee and charges as agreed in this Loan Agreement.

In the event P2PL undertakes the aforesaid actions on behalf of the Lenders, all costs incurred directly or indirectly for the purpose of recovery of the dues shall be borne by the Lenders.

The following events shall constitute events of default:

a) Any representation or warranty made in relation to this Agreement or any certification or document delivered, is proved to be incorrect in any material aspect;

b) The Borrower (a) fails to pay the Loan Amount, interest thereon and any other fee and charges when due hereunder, or (b) fails to perform or observe any other term or covenant contained in this Agreement.

c) Any e-NACH/UPI mandate delivered or to be delivered by the Borrower to the Lenders in terms and conditions hereof is not realized for any reason whatsoever on presentation.

d) Any instruction being given by the Borrower for stop payment of any e-NACH/UPI mandate for any reason whatsoever.

e) The Borrower admits in writing its inability to pay the Loan Amount, interest thereon and any other fee and charges on becoming due; or any proceeding is instituted by or against the Borrower seeking to adjudicate him as bankrupt or insolvent under any law relating to bankruptcy or insolvency; or in the event of the death of the Borrower.

f) Any government, judicial or quasi-judicial authority takes any action against the Borrower which could have an adverse effect on the repayment of the Loan Amount, interest thereon and any other fee and charges payable to the Lender.

g) Any default of the Borrower in respect of any agreement or contract with other parties in respect of its indebtedness, borrowings or pre-mature repayment thereunder.

9. INDEMNIFICATION

Each Party shall, at all times, at present and thereafter, defend, indemnify and hold harmless the other Party, agents and representatives from and against any and all liabilities, suits, claims, actions, proceedings, losses, damages, judgments and costs, of any nature whatsoever (including Attorney’s fees) (each, a “Claim”) caused due to non-compliance of the terms and conditions of this Agreement, breach of representation and warranties, breach of covenants, or non-compliance of any applicable laws and regulations, breach of the confidentiality obligations and infringement of third-party intellectual property rights, damage to any third party’s property or body. This clause shall survive the expiry or termination of this Agreement.

10. TERMINATION

This Agreement may be terminated:

a. By mutual written agreement of the Parties;

b. If any law or regulation or any amendment thereto makes the transaction or the Agreement illegal, or is otherwise prohibited by law or by an order, decree or judgment of any court or governmental body having competent jurisdiction;

c. The Lenders may terminate this Agreement:

In case of non-compliance of the Borrower’s obligations specified under this Agreement, involvement of the Borrower in any prohibited or illegal purpose, the Borrower’s failure to abide by the terms and conditions of this Agreement or any applicable law for the time being in force.

i. By giving notice to the Borrower, in the event of a material misrepresentation or breach of a warranty or breach of covenant on the part of the Borrower.

ii. By giving notice to the Borrower, if any event or circumstance occurs which, in the opinion of the Lenders, could have a material adverse effect on the fulfilment of the obligations of the Borrower under this Agreement.

11. SEVERABILITY

If any provision of this Agreement is determined to be unenforceable in whole or in part for any reason, then such provision or part shall to that extent be deemed deleted from this Agreement and the legality, validity and enforceability of the remaining provisions of this Agreement shall not be in any way affected thereby and any act of omission / commission of the Parties hereto done prior to the provisions being held unenforceable shall be deemed to be valid and / or binding on the other.

12. NOTICES

• Any notice required or contemplated by this Agreement shall be in writing and shall be transmitted by postage prepaid, or by email, or by registered post with acknowledgement due or by a recognized courier services, to the other Party at the address set out in this Agreement.

• Either Party may, from time to time, change its address for correspondence of the notices provided for in this Agreement, by giving the other Party not less than 10 day’s prior written notice.

13. FORCE MAJEURE

• No party shall be liable to the other if, and to the extent, that the performance or delay in performance of any of its obligations under this Agreement is prevented, restricted, delayed or interfered with, due to circumstances beyond the reasonable control of such party, including but not limited to, Government legislations, fires, floods, explosions, epidemics, accidents, acts of God, wars, riots, strikes, lockouts, or other concerted acts of workmen, acts of Government and / or shortages of materials, hacking, unanticipated technological or natural interference or intrusion, loss or damage to satellites, loss of satellite linkage or any other data communications linkage, loss of connectivity or any other irresistible force or compulsions

• The Party claiming an event of force majeure shall promptly notify the other parties in writing and provide full particulars of the cause or event and the date of first occurrence thereof, as soon as possible after the event and also keep the other Party informed of any further developments. The Party so affected shall use its best efforts to remove the cause of non-performance, and the Parties shall resume performance hereunder with the utmost dispatch when such cause is removed.

ENTIRE AGREMENT

This Agreement constitutes the entire understanding between the Parties and superseded all previously entered agreements and understandings between the Parties, oral or written. All warranties, undertakings and agreements given herein by the parties shall be binding upon the parties and upon its legal representatives and estates.

14. DAMAGES NOT AN ADEQUATE REMEDY

Without prejudice to any other rights or remedies that the Parties may have, it is acknowledged that damages alone would not be an adequate remedy for any breach of this Agreement and that the remedies of injunction, specific performance and other equitable relief for any threatened or actual breach of any of the provisions of this Agreement are appropriate remedies.

15. DISPUTE RESOLUTION

In the event that any disputes, differences, claims and questions whatsoever between the parties hereto arising out of or in connection with or incidental to or touching this Agreement or the construction or application thereof or any clauses or thing herein contained or in respect of any account and the duties, responsibilities and obligations of either party hereunder or as to any act or omission of any party or as to any other matter in anywise relating to these presents or the rights, duties and liabilities of either party under these presents shall, as far as possible, be amicably settled by mutual discussions.

In the event the dispute remains unresolved, such differences or disputes shall be referred to and settled by Arbitration in accordance with the Indian Arbitration & Conciliation Act, 1996 or any statutory modification or re-enactment thereof for the time being in force. The venue of the arbitration shall be at Bangalore. The language of the arbitration shall be English. The arbitration panel shall consist of a sole arbitrator. Each Party shall bear its own cost of arbitration.

16. GOVERNING LAW AND JURISDICTION

This Agreement shall be governed by and construed in accordance with law prevalent in India. The Parties hereby agree that the Courts having jurisdiction in Bangalore shall have exclusive jurisdiction to hear and decide any suit, action or proceedings and to resolve any disputes, arising in connection with this Agreement and the Parties hereby submit to the jurisdiction of the Indian Courts.

17. WAIVER

No failure to exercise or delay in exercising any right or remedy under this Agreement shall constitute a waiver thereof and no waiver by any Party of any breach or non-fulfilment by any other Party of any provision of this Agreement shall be deemed to be a waiver of any subsequent or other breach of that or any other provision hereof. No single or partial exercise of any right or remedy under this Agreement shall preclude or restrict the further exercise of any such right or remedy. The rights and remedies provided in this Agreement are cumulative and not exclusive of any rights and remedies provided by law.

18. MISCELLANEOUS

• This Agreement may not be amended for any other reason without the prior written agreement of both Parties.

• This Agreement contains the entire understanding of the Parties with respect to the subject matter contained herein and supersedes all prior agreements and understandings both oral and written between the Parties with respect to such subject matter.

• No modification or amendment of this Agreement shall be valid or binding unless made in writing and agreed to by the Parties.

IN WITNESS WHEREOF THE PARTIES OR THEIR AUTHORISED REPRESENTATIVES HAVE PUT THEIR RESPECTIVE HANDS THE DAY AND YEAR FIRST HEREINABOVE WRITTEN.

IN WITNESS WHEREOF THE PARTIES OR THEIR AUTHORISED REPRESENTATIVES HAVE PUT THEIR RESPECTIVE HANDS THE DAY AND YEAR FIRST HEREINABOVE WRITTEN.

| Signature of authorized Agent of Lenders | Signature of Borrower |

Annexure I

Name and Particulars of the Lenders

| Lender ID | Lender Name (Masked) | Amount in Rs. |